Getting The Stonewell Bookkeeping To Work

Wiki Article

Not known Facts About Stonewell Bookkeeping

Table of ContentsStonewell Bookkeeping - The FactsThe 8-Second Trick For Stonewell BookkeepingStonewell Bookkeeping Fundamentals Explained4 Easy Facts About Stonewell Bookkeeping ExplainedUnknown Facts About Stonewell Bookkeeping

Right here, we respond to the concern, how does accounting assist a business? Truth state of a company's funds and money flow is always in change. In a feeling, accountancy books represent a picture in time, yet just if they are upgraded usually. If a company is absorbing little bit, an owner has to take activity to raise earnings.

It can additionally settle whether or not to increase its very own payment from clients or consumers. None of these conclusions are made in a vacuum as factual numerical info need to buttress the economic decisions of every little company. Such data is assembled via bookkeeping. Without an intimate expertise of the dynamics of your cash money circulation, every slow-paying client, and quick-invoicing lender, comes to be an event for anxiety, and it can be a tedious and monotonous job.

Still, with appropriate capital monitoring, when your books and journals depend on date and systematized, there are much less enigma over which to fret. You recognize the funds that are offered and where they fail. The news is not constantly great, yet at least you understand it.

An Unbiased View of Stonewell Bookkeeping

The puzzle of deductions, credits, exemptions, timetables, and, of training course, penalties, suffices to merely give up to the internal revenue service, without a body of well-organized paperwork to sustain your cases. This is why a committed bookkeeper is invaluable to a small company and is worth his or her weight in gold.

Your business return makes insurance claims and representations and the audit targets at verifying them (https://anyflip.com/homepage/lhcti). Excellent bookkeeping is all about attaching the dots in between those depictions and reality (business tax filing services). When auditors can adhere to the information on a ledger to receipts, bank declarations, and pay stubs, among others papers, they rapidly find out of the expertise and integrity of the business organization

9 Easy Facts About Stonewell Bookkeeping Explained

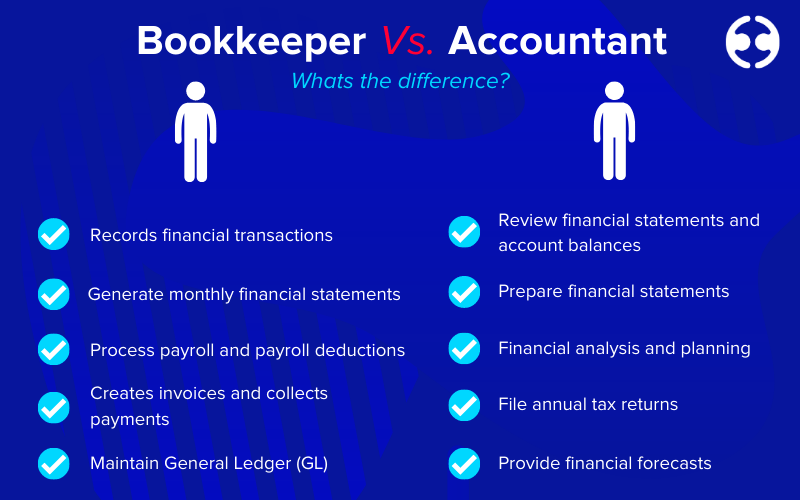

In the very same way, careless bookkeeping includes in anxiety and anxiousness, it additionally blinds local business owner's to the possible they can recognize in the future. Without the details to see where you are, you are hard-pressed to establish a location. Only with understandable, detailed, and valid data can a local business White Label Bookkeeping owner or management group plot a program for future success.Local business owner understand best whether an accountant, accounting professional, or both, is the ideal option. Both make vital payments to a company, though they are not the same career. Whereas an accountant can gather and organize the details needed to support tax obligation preparation, an accountant is much better suited to prepare the return itself and actually examine the revenue declaration.

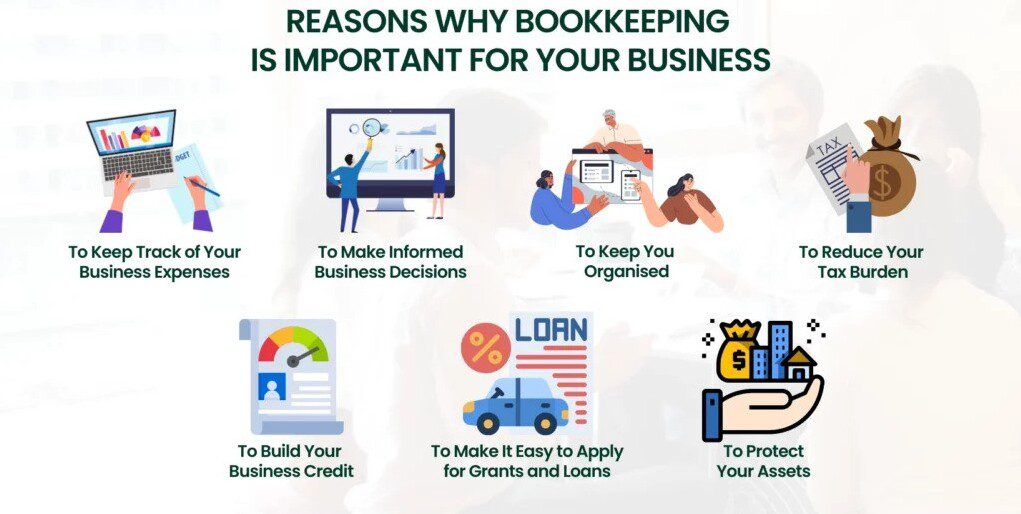

This article will dive into the, consisting of the and exactly how it can benefit your business. Accounting entails recording and organizing monetary deals, including sales, acquisitions, repayments, and receipts.

This article will dive into the, consisting of the and exactly how it can benefit your business. Accounting entails recording and organizing monetary deals, including sales, acquisitions, repayments, and receipts.By frequently upgrading economic documents, accounting assists services. This helps in conveniently r and conserves businesses from the stress and anxiety of browsing for papers during deadlines.

A Biased View of Stonewell Bookkeeping

They are primarily worried concerning whether their money has actually been utilized properly or not. They certainly need to know if the business is making cash or not. They additionally would like to know what possibility business has. These elements can be conveniently managed with accounting. The profit and loss statement, which is ready consistently, shows the revenues and additionally figures out the possible based upon the profits.Therefore, accounting assists to stay clear of the troubles connected with reporting to financiers. By maintaining a close eye on economic documents, companies can establish reasonable objectives and track their development. This, consequently, cultivates much better decision-making and faster company growth. Government policies commonly require companies to keep economic documents. Normal bookkeeping makes certain that businesses stay compliant and prevent any type of penalties or lawful concerns.

Single-entry bookkeeping is basic and functions best for local business with couple of transactions. It involves. This method can be contrasted to keeping a straightforward checkbook. Nonetheless, it does not track assets and responsibilities, making it less detailed contrasted to double-entry bookkeeping. Double-entry accounting, on the various other hand, is extra sophisticated and is typically thought about the.

Our Stonewell Bookkeeping Statements

This could be daily, weekly, or monthly, depending on your business's size and the volume of purchases. Do not hesitate to seek aid from an accounting professional or bookkeeper if you locate managing your economic records testing. If you are trying to find a complimentary walkthrough with the Audit Service by KPI, call us today.Report this wiki page